Accounting Principles: What They Are and How GAAP and IFRS Work

We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. All programs require the completion of a brief online enrollment form before payment. If you are new to HBS Online, you will be required to set up an account before enrolling in the program of your choice.

How to calculate accrual basis net income?

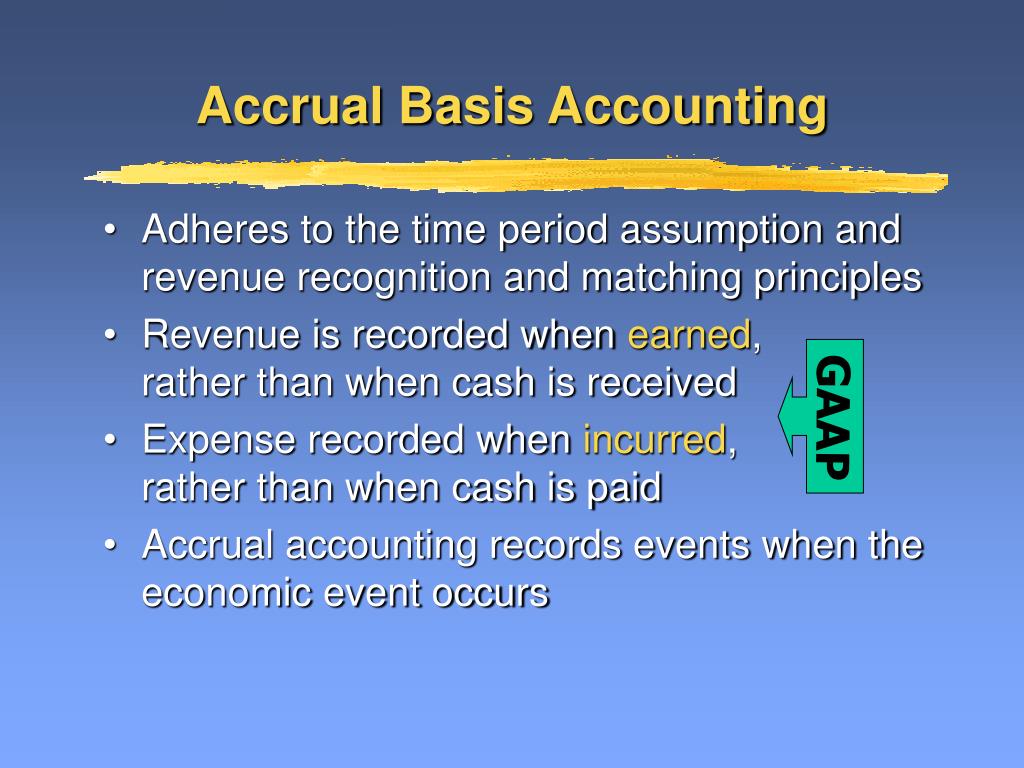

That’s because it doesn’t record accounts payables that might exceed the cash on the books and the company’s current revenue stream. The accrual method uses the matching principle method, an important factor in business accounting. In this case, expenses and revenues are reported in the same period and are ‘matched’ to determine profits or losses of that financial period. Income refers to the difference between sales or revenues and expenses for a period.

Understanding OCBOA Frameworks in Financial Reporting

Yes, it’s always possible to switch from the cash method to accrual accounting or vice versa. It’s a big undertaking that will require a full system overhaul, and you’ll need to file Form 3115 with the IRS, but it’s your business, and you can run it how you want to. Accrual accounting is good for larger, public businesses, companies of any size that have to deal with inventory, and businesses that have earned more than $25M gross over 3 years.

Accrual Accounting: Principles, Differences, and Financial Impact

For instance, a construction company working on a long-term project would recognize revenue as the project progresses, rather than waiting until the entire project is completed and paid for. It can obscure the true financial performance of a business, especially for those with significant receivables or payables. For instance, a company might appear highly profitable in a period where it receives large payments for past services, even if it incurs substantial expenses in the same period that are not yet paid. This can lead to misleading financial statements that do not accurately reflect the company’s ongoing operations.

Accrual Accounting

This method is more accurate than cash basis accounting because it tracks the movement of capital through a company and helps it prepare its financial statements. During an unpaid leave of absence, organizations often adjust vacation accruals to reflect the period of inactivity. Since the employee is not actively contributing hours, some companies choose to pause accruals until the employee returns. This approach maintains the integrity of the accrual system, ensuring that vacation time is earned proportionate to active service. However, to avoid legal pitfalls, companies should ensure that their policies align with local and federal regulations, which may mandate accrual continuation under certain circumstances.

Accrued Expenses

- Since accrual expenses and revenues exist, investors can easily determine how quickly a company pays off its liabilities or collects on its receivables.

- This can lead to misleading financial statements that do not accurately reflect the company’s ongoing operations.

- The vast majority of companies that people would potentially invest in will be using accrual-based accounting.

- The Conceptual Framework refers to a ‘reporting entity’ which is an entity that is required, or chooses, to prepare financial statements.

- The business entity principle simply means that, for the purpose of maintaining accounting records, the business is treated as a separate entity from the owner(s) of the business.

For this reason, candidates would be wise to complete as many practice questions as possible before taking the exam. It is also the reason why the topic can only be touched on briefly in a short article such as this. There is often uncertainty about the eventual outcome of certain events and transactions. Prudence requires dependent tax deduction that, whenever such uncertainty exists, preparers of financial statements take a careful approach to the figures and information that they include in the financial statements. Consistency is a straightforward principle and is intended to enhance financial reporting by making it easier for users to make comparisons.

Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

While accrual accounting is the most widely used accounting method, some businesses prefer to use cash basis accounting. Cash accounting is an accounting method in which revenue is only recorded when cash is received, and expenses are recorded after cash payments are made. Cash basis accounting records revenue and expenses when actual payments are received or disbursed. On the other hand, accrual accounting records revenue and expenses when those transactions occur and before any money is received or paid out. The accrual concept of accounting requires that accounting records, including journal, ledger, and income statement, reflect transactions at the time when they actually occur, not necessarily when cash changes hands. This basis of accounting is generally used by companies for preparing their financial statements, except the cash flow statement.

This means a purchase will only be recorded once the invoice is paid in full, while expenses are only noted once they’ve been paid and the money leaves the bank. Accruals do come with several pros and cons, but the main issue is the degree of accuracy involved. This information should always be used alongside other performance metrics to provide an accurate picture for investors.

The Securities and Exchange Commission (SEC), the U.S. government agency responsible for protecting investors and maintaining order in the securities markets, has expressed interest in transitioning to IFRS. However, because of the differences between the two standards, the U.S. is unlikely to switch in the foreseeable future. Understanding its principles is crucial for stakeholders who rely on precise financial data to make informed decisions. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.